Dispute resolution checks are a critical component of background screening, aiming for accuracy and fairness by addressing errors like incorrect SSNs, inaccurate addresses, and outdated information. This process involves reviewing provided documents, employing specialized personnel, and maintaining transparent procedures to protect both individuals' rights and organizations' reputations. Proactive measures, such as regular record updates, staying informed about legal changes, and implementing efficient dispute resolution protocols, minimize errors in background checks. Understanding relevant laws like the FCRA and adhering to best practices ensures a fair and accurate screening process.

Background checks are a critical component of hiring, tenant screening, and more. However, errors are inevitable. This article guides you through the process of correcting these mistakes, focusing on dispute resolution. From understanding common errors like data inaccuracies and procedural lapses to implementing preventative measures for enhanced accuracy, we break down effective steps. Learn best practices, legal considerations, and strategies to ensure fairness and efficiency in resolving check disputes.

- Understanding Dispute Resolution in Background Checks

- Identifying Common Errors in Background Screening

- The Step-by-Step Guide to Correcting Check Errors

- Legal Considerations and Best Practices for Resolution

- Preventative Measures: Enhancing Future Checks' Accuracy

Understanding Dispute Resolution in Background Checks

When it comes to background checks, dispute resolution is a critical process designed to ensure accuracy and fairness. This involves addressing any discrepancies or errors that may have crept into the initial screening process, which is essential for protecting both individuals’ rights and the organization’s reputation. Understanding dispute resolution checks is key to navigating potential issues effectively.

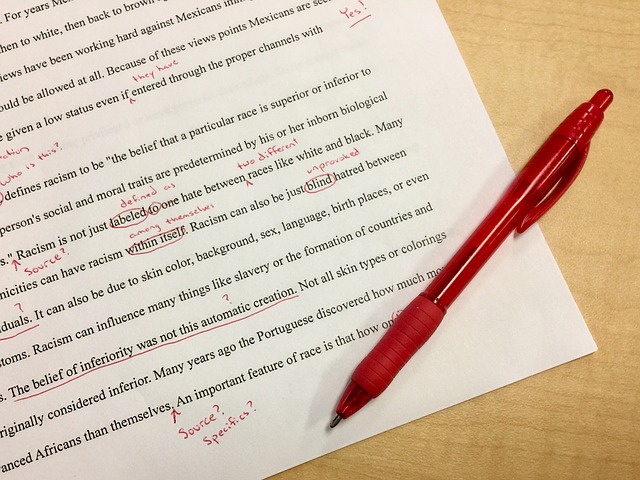

The first step in dispute resolution is typically a thorough review of the information provided by the individual seeking clarification or correction. This includes examining supporting documents, such as old employment records or court documents, to verify the existence (or non-existence) of any errors. Organizations should establish clear procedures for handling disputes, ensuring a transparent and impartial process. This might involve designated individuals who specialize in verifying documentation and facilitating fair resolutions.

Identifying Common Errors in Background Screening

Background screening is a crucial process for employers, but it’s not immune to errors. Identifying common mistakes early can streamline dispute resolution checks and ensure a more accurate representation of an applicant’s history. Some frequent errors include incorrect social security numbers, inaccurate addresses, typographical mistakes in names or dates, and the inclusion of outdated information. These oversights can lead to false positives or negatives, impacting both the candidate’s chances and the employer’s hiring decisions.

To navigate these issues effectively, employers should establish robust verification protocols. This involves cross-referencing data from multiple sources, employing advanced screening technologies, and implementing systematic dispute resolution processes. Regularly updating records and staying informed about changes in legislation and industry best practices are also vital to minimizing errors.

The Step-by-Step Guide to Correcting Check Errors

Correcting errors in background checks is a crucial process, especially when aiming for accuracy and fairness in hiring or admitting individuals. Here’s a step-by-step guide to navigating this process effectively. First, identify the error—review the check thoroughly, noting discrepancies or inaccurate information. Once identified, gather supporting documents or evidence that proves the information is incorrect. This could include pay stubs, bank statements, official records, or even witness testimonies.

Next, initiate the dispute resolution checks by contacting the reporting agency or the entity responsible for the background check. Clearly communicate the specific errors found and provide your supporting documentation. They may request additional verification from you or the source of the incorrect data. Throughout this process, maintain detailed records of all communications, including dates, names, and any resolutions reached. This documentation will be invaluable if further appeals are necessary.

Legal Considerations and Best Practices for Resolution

When addressing errors in background checks, understanding legal considerations and best practices for dispute resolution is crucial. The first step involves reviewing applicable laws and regulations that govern background screening processes, such as the Fair Credit Reporting Act (FCRA) in the U.S., which outlines consumer rights regarding their credit reports and the handling of disputes. These laws ensure that employers or organizations conduct checks fairly and provide individuals with the right to challenge inaccurate information.

Effective dispute resolution requires a systematic approach. Start by thoroughly examining the background check report for discrepancies or errors. Collect supporting documentation, such as original records or alternative sources confirming the accurate details. Engage in open communication with the reporting agency, providing clear evidence of the inaccuracies. Many agencies have established procedures for handling disputes, which may include requesting corrections or amendments to the report. Document every interaction and keep detailed records for future reference, ensuring a transparent process that respects individual rights while striving for accuracy in background checks.

Preventative Measures: Enhancing Future Checks' Accuracy

To ensure the accuracy of future background checks, it’s essential to implement preventative measures. One crucial step is proactive dispute resolution checks. This involves regularly reviewing and disputing any inaccuracies that may have crept into your records. By actively managing your personal information, you can mitigate errors before they impact subsequent checks.

Additionally, staying informed about the data you provide is vital. Regularly audit the information on your credit reports and public records to ensure its completeness and accuracy. This proactive approach empowers individuals to take control of their background check process, enhancing overall reliability and reducing the chances of false positives or negatives.