Understanding legal rights in check disputes is vital for consumers. Major credit bureaus (Equifax, Experian, TransUnion) handle errors, and clear communication with them is key. Provide relevant details, maintain records, and request specific corrections politely and professionally to ensure accurate credit reports.

“Uncover the secrets to effectively rectify errors in your reports through contacting reporting agencies. In this comprehensive guide, we explore your legal rights in check disputes, helping you identify the right agencies for corrections. Learn powerful communication strategies to ensure your message is heard and acted upon promptly. By understanding your entitlements and following best practices, you can navigate the process with confidence, ensuring accuracy in your records.”

- Understanding Your Legal Rights in Check Disputes

- Identifying Correct Agencies for Corrections

- Effective Communication Strategies for Contacting Agencies

Understanding Your Legal Rights in Check Disputes

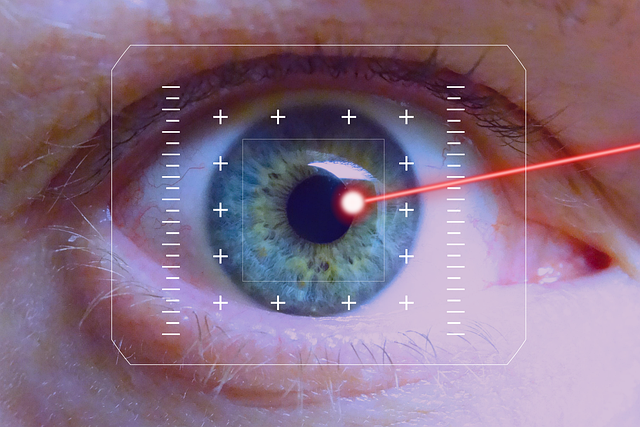

When it comes to check disputes, knowing your legal rights is essential. In many countries, consumers are protected by laws that regulate banking practices and financial transactions. These laws empower individuals to challenge inaccurate or fraudulent check information. Understanding your rights can help you navigate the dispute process effectively.

One key right is the ability to request corrections from reporting agencies. If there’s an error on a check, such as an incorrect amount or invalid account details, consumers have the legal standing to contact these agencies and initiate correction procedures. This process involves providing valid documentation and verifying the information to ensure accuracy. Familiarize yourself with your country’s specific regulations regarding check disputes and legal rights to make informed decisions when confronting such issues.

Identifying Correct Agencies for Corrections

When it comes to correcting inaccurate information on your credit report, knowing which agencies to contact is crucial. The process can seem daunting, but understanding your legal rights and navigating the system effectively is key. Start by identifying the specific credit bureaus responsible for the reports in question. In many countries, there are three major credit bureaus: Equifax, Experian, and TransUnion. If you have disputes with multiple agencies, it’s important to know that each bureau has its own procedures for resolving errors.

Your legal rights entitle you to challenge any inaccuracies and request corrections through these agencies. They must verify the information or remove it from your report if found invalid. Keep detailed records of your communications, including dates, names, and outcomes, as this will be valuable in verifying your efforts should disputes arise.

Effective Communication Strategies for Contacting Agencies

When contacting reporting agencies regarding corrections, clear and concise communication is key. Begin by identifying the specific agency responsible for the information in question. Check their website or contact page for dedicated sections on disputes or legal rights checks. Prepare your inquiry with relevant details – include the original report identifier, the aspects you wish to correct, and any supporting documents or evidence.

Use a polite and professional tone throughout your interaction. Present your case objectively, providing factual information rather than personal opinions. Be specific in your requests for changes and offer clear explanations as to why corrections are necessary. Keep records of all communications, including dates, names of individuals contacted, and the details discussed, to ensure accountability and facilitate any further actions if needed.