Unresolved check disputes cause financial and operational issues, affecting cash flow, business obligations, stability, and customer trust. Disputes often arise from background report errors due to data entry mistakes, altered checks, or account status changes. Mitigate risks by obtaining detailed dispute reports, identifying transaction errors, implementing quick fixes, monitoring resolutions, and maintaining accurate records to prevent future errors and preserve positive cash flow.

Unresolved check disputes can have profound implications for businesses, leading to financial losses, operational disruptions, and damaged customer relationships. This article delves into the intricate world of check disputes, focusing on how unresolved issues impact businesses and the role of dispute background report errors as a common cause. We’ll also explore effective strategies to mitigate the consequences, ensuring your business navigates this complex landscape with confidence. By understanding these dynamics, you can foster smoother financial transactions.

- Check Disputes: Unresolved Issues Impact Businesses

- Common Causes of Check Dispute Background Report Errors

- Strategies to Mitigate Consequences of Unresolved Checks

Check Disputes: Unresolved Issues Impact Businesses

Unresolved check disputes can have significant implications for businesses, leading to a cascade of problems that extend far beyond mere financial setbacks. When a check is disputed, it often indicates underlying issues such as background report errors, fraudulent activities, or simple misunderstandings. These disputes can result in delayed cash flow, impacting the ability of businesses to meet their financial obligations and maintain operational stability.

Moreover, unchecked disputes create an uncertain environment for both businesses and their customers. Accurate record-keeping and efficient dispute resolution processes are essential to mitigate these risks. By addressing check dispute backgrounds promptly and accurately, businesses can ensure a steady financial stream, protect their reputation, and foster customer trust.

Common Causes of Check Dispute Background Report Errors

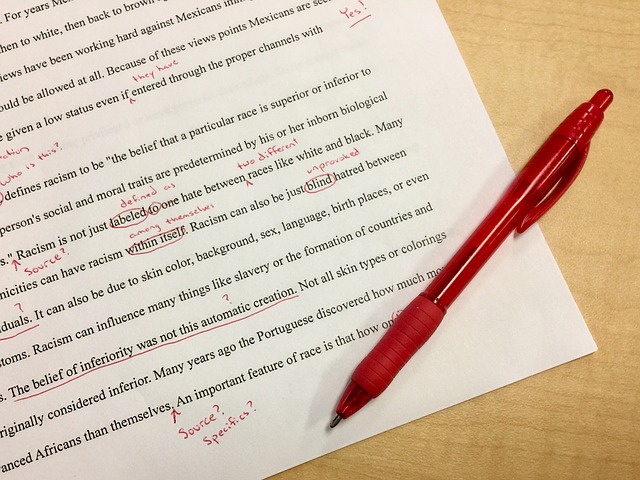

Check disputes often arise due to a variety of reasons, leading to errors in dispute background reports. Common causes include data entry mistakes, where simple typos or incorrect information can create significant issues. These errors might result from hurried processing or inadequate verification of the original check details. Another frequent cause is when checks are altered or tampered with after issuance, making it challenging for systems to accurately match the records.

Moreover, disputes can occur due to changes in account statuses, such as closed accounts or incorrect routing numbers. In some cases, checks may be presented for payment after the funds have been withdrawn, leading to discrepancies. Timely updates and accurate record-keeping are crucial to minimizing these errors. Institutions should implement robust data validation processes to ensure the integrity of dispute background reports.

Strategies to Mitigate Consequences of Unresolved Checks

To mitigate the consequences of unresolved check disputes, individuals and businesses should proactively address potential issues. Start by obtaining a detailed dispute background report to identify any errors or discrepancies in the transaction records. This initial step is crucial as it provides insights into the root cause of the problem.

Once errors are identified, implement strategies to rectify them promptly. This may involve resubmitting the check with corrected information, contacting the bank for clarification, or communicating directly with the merchant to resolve any misunderstanding. Regularly monitoring the dispute status and keeping accurate records of all communications can help ensure timely resolution, minimizing financial losses and maintaining a positive cash flow.